- Trade/Investment

- Economic Indicators

- Trading

- Investment

- Legal Framework

HOME > Trade/Investment > Investment

Investment

- INVESTMENT HOTSPOT

Business friendly and tax efficient, Paraguay is open for business -

- PARAGUAY has a unique macroeconomic situation and features favourable characteristics, in that it has a historically low average rate of inflation at around 5% (in 2013, the rate was 3.7%), and international reserves that total at least 20% of GDP, which is twice the amount of the country's external debt. On top of such excellent signs, the country has renewable energy production of 8,100 MW from its two major hydroelectric dams, the immense Itaipu on the Brazilian border, the Yacyretá shared with Argentina, and the smaller Acaray, with current domestic demand of just 2,300 MW, leaving over 6,000 MW for export.

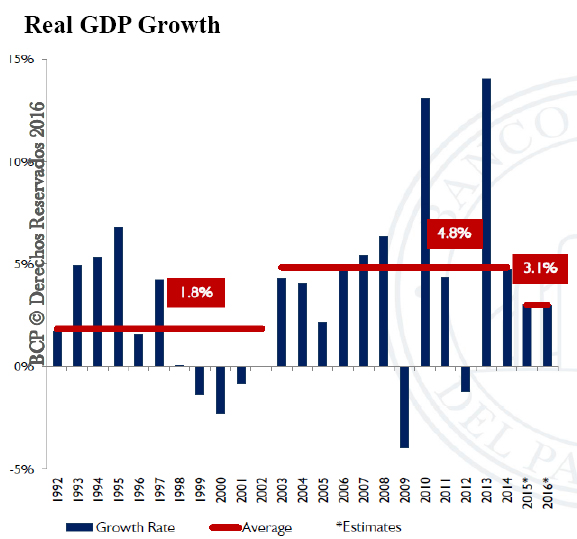

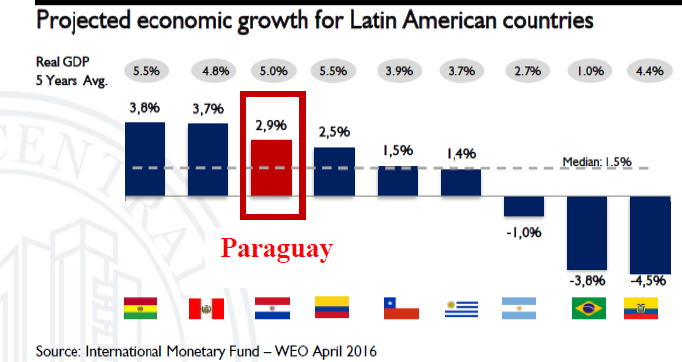

- Couple this with the superb growth rates the country has seen over the last few years, where in 2010 and 2013, Paraguay experienced the greatest economic expansion of the MERCOSUR zone and the highest in South America, with a GDP growth rate of 14.5% and 13.6% respectively, and the ground is ripe for investment.

- The excellent situation in which the country currently finds itself is no surprise, as the whole machinery of government has been working towards avoiding the pitfalls of bad macroeconomic policy, a typical problem for governments in the region.

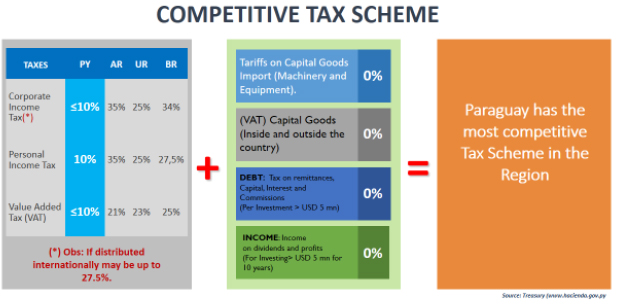

- Paraguay has a very solid and attractive fiscal regime, which is a big draw for investors, both local and foreign. Paraguay want to promote the creation of jobs and so have lowered and simplified the tax rates to 10% VAT, 10% corporate tax, and 10% personal income tax. For 20 years between 1980 and 2003 economic growth lagged behind in comparison to other countries. In 2003 things began to change, when a new government took office and signed a standby arrangement with the IMF. Over the next few years they began the implementation of many reforms, particularly in areas of fiscal policy, tax reform, reducing corporate taxation from 30% to 10%, and by bringing an increasing formalization of the economy. It has seen an outstanding performance by the Central Bank, which brought both strong credibility and positive fiscal performance.

- The country has managed to avoid devaluation of the Guaraní since its inception over 70 years ago, and has always had a favourable global trade balance, a result of the careful planning of previous governments.

- However, the positive current situation – which has seen foreign reserves and investments in the country climb, is the expected result of having the entire government pulling in the same direction. However, thanks are also owed to the decision of President Horacio Cartes to fill his cabinet with technocrats and business people, unlike previous administrations.

- In economics there are no miracles. In many cases across Latin America it has seen the authorities attempt miracles or shortcuts to success, which lead them to failure, as they try to do everything at the same time. What we are doing here is taking small steps towards success.

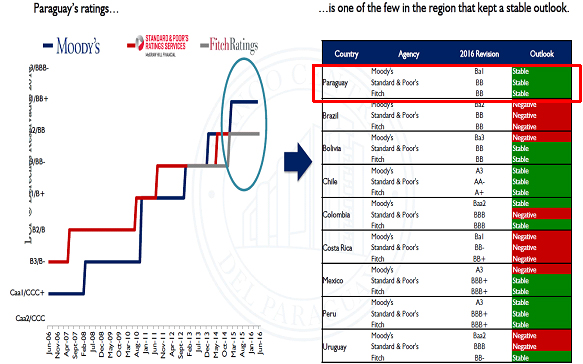

- This confidence in Paraguay's economic policy is borne out by the reception the country has received on international bond markets, and also from global ratings agencies such as Moody's and Standard & Poors. The first thing is that any profit earned by businesses here is going to retain its value, because we have a history of low inflation. Paraguay also has the second oldest currency of the region – over seventy years old – and has a good history of currency stability.

- The second thing is that we can guarantee investors are going to be able to send their money to their countries, because we have a comfortable level of international reserves. We don't have any policy that restricts or restrains remittances or profits to anywhere outside the country. It is important to have a sound fiscal policy, otherwise we would be putting too big a strain on monetary policy. If it is too expansionary and we want to control price increases, we may have to raise the interest rate above reasonable levels, which is something that is happening in neighboring countries. To deliver low inflation it is imperative that we are fiscally sustainable..

- From 2003, Paraguay began an eight-year stretch of accumulating fiscal surpluses, which brought the national debt levels down from a not-unhealthy 60% of GDP to less than 20% today. However, previous governments did not set aside enough capital to fully invest in and improve the country's ageing infrastructure, one of the key components of a successful global economy.

- In 2012, the government started to implement a more ambitious agenda with a key focus on investing in infrastructure projects. Following this, the government implemented a framework that would allow us to continue to invest while safeguarding ongoing sustainability.

- For that purpose, the government implemented three laws, which were very important in our aim to close the main economic gaps of Paraguay. The Fiscal Responsibility Law that calls for a cap in the deficit of 1.5%, the Public Private Partnership (PPP) law, and the tax reform, which broadens the tax base by almost 140,000 people."

- These new laws introduced by the administration had an almost immediate effect on the diversification of the economy, allowing for new companies and industries to move into Paraguay and take full advantage of the country's other beneficial policies. It was one the key factors in changing the laws that govern capital expenditure and repatriation of profit, both of which are closely linked to the Maquila style of business, which is a piece of legislation designed to boost Paraguay's process of adding value – meaning more completed goods are produced in country, therefore increasing the value of exports.

- In the future we are going to see more diversification and key for us will be to become further integrated into the Brazilian economy, which we are already achieving through the Maquila regime. Two years ago nobody talked about Maquila in Paraguay, it was very small. But now it has become a $350 million industry. In two years we were able to increase Maquila exports by 70%, and this will continue to rise because a new factory has opened near Asunción.

- After the financial crisis we reviewed all the legislation, and the bank superintendent tightened up on supervision. This allowed the financial sector to grow from around 30% GDP in credit at that time to more than 45% GDP in credit right now, and that is a big transformation. Given the returns banks are achieving here, I'm surprised that more banks are not arriving. Itau and BBVA are very happy about their performance in Paraguay, which is one of the most productive markets in the whole region for them.

- The confidence of the government is also explained by the glowing reports the country has had from many of the global ratings agencies, which have placed Paraguayan debt as just one notch below investment grade, meaning not only does borrowing on international markets come with a lower rate of interest and better conditions for repayment, but also that international investors can relax in the knowledge that some of the most stringent tests for the macroeconomic policies of any country have been passed with flying colors.

- The country is ready for growth, and that all sectors of the economy are firing. At the beginning of the year Paraguay received a visit from Moody's Investor Services, who were evaluating Paraguay. We wanted to show them the future of the Paraguayan economy and not just the soy and meat exports.

- We took them to the modern plant of auto parts manufacturer THN and then to CAIASA, which is a joint venture between two large agro-industrial companies that uses some of the most advanced technology available in the world today. Paraguay is processing almost half of its total crop of soy, exporting to the most competitive markets around the globe. Our Maquila plants, with good labor and cheap and plentiful energy supplies are now making Paraguay a powerhouse in this industry.