- Trade/Investment

- Economic Indicators

- Trading

- Investment

- Legal Framework

HOME > Trade/Investment > Trading

Trading

- Trading all the way to the top

-

- Paraguay is undergoing rapid development in its industrial and commercial sectors by developing free trade zones, instigating a simplified tax system that is the most competitive in the region, and using its prime geographical position to take advantage of trade on either side of the continent, looking to the Pacific and Atlantic Oceans as gateways to trade its goods throughout the world.

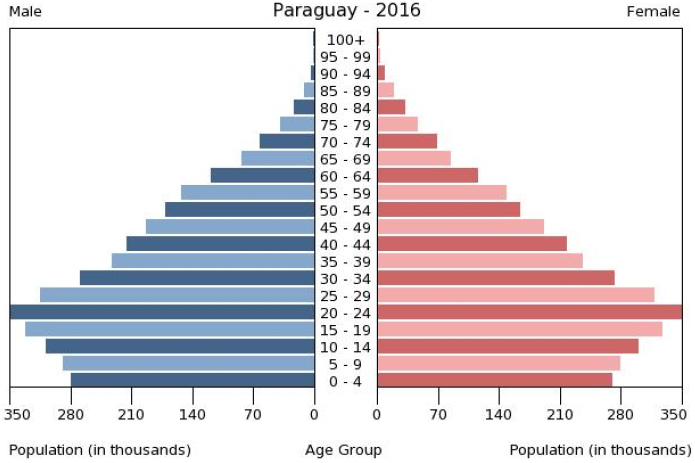

- The local population, as both the recipient of the improved deal the Cartes government is offering and one of the driving forces behind it, is a huge draw for companies looking to enter a country with a productive workforce. With some 70% of the population aged under 34, Paraguay is really in the demographic sweet spot, meaning the majority of the country is in the prime of their working lives – a double bonus for the country in the form of reduced social spending via increased empl

-

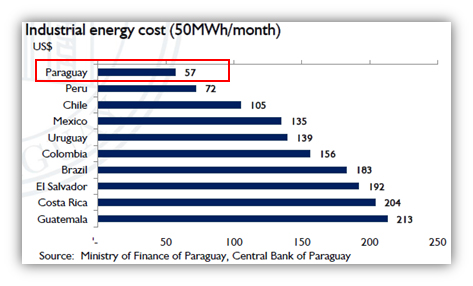

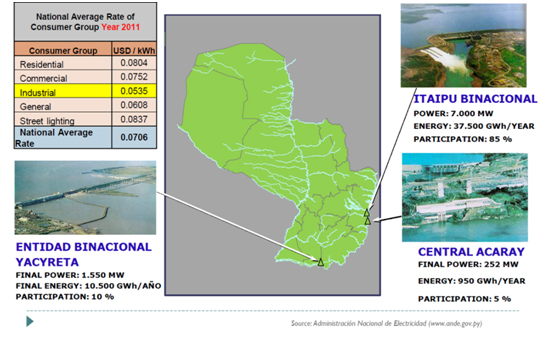

- Paraguay is also blessed with the cheapest labour costs in the region, and the cheapest energy costs too, with 99% of the country's energy use provided by renewable, green energy – directly from Itaipu hydroelectric plant or one of the other strategically located dams that are powering Paraguay's economic growth.

- The new Paraguay, however, has already begun improving international bilateral relations with its close neighbours, as well as countries further afield. 20% of Paraguayan exports head directly to Brazil, but come from Brazilian companies headquartered in São Paulo, who operate out of the Paraguayan capital Asunción. This advanced and symbiotic relationship between the two countries shows just how far Paraguay has come in developing and strengthening relationships with its powerful neighbours, and gives a strong indication of the way they would like to develop and strengthen the economy.

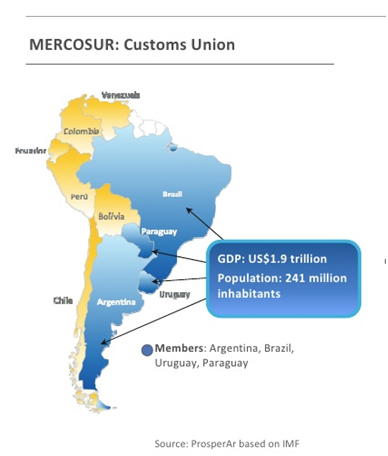

- As a player in the MERCOSUR agreement, the free trade block consisting of Brazil, Uruguay and Argentina, with a majority of the remaining South American countries as associate members, Paraguay has a privileged position from which to trade. This allows foreign investors to take advantage of Paraguay's competitive taxation framework and high productivity. In effect, Paraguay has the potential to become the central nervous system to the region: a powerhouse making its space in the main arena.

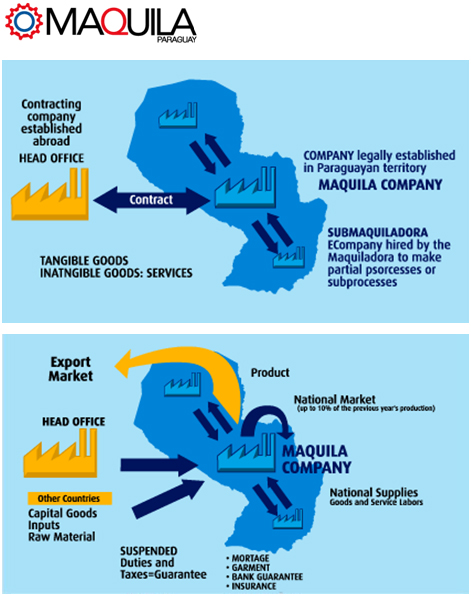

- A great deal of the confidence that the country shows comes from the adoption of the Maquila Regime doctrine, a Mexican system of regulation that allows a local company, branch or subsidiary to sign a contract with a foreign entity to produce goods or provide services for export only, with the local producer operating 'for account and risk of the foreign company.'

- The foreign company can also import or buy locally all raw materials needed from any supplier, freeing up each company to get the best possible deal for all parties involved. Any person or company, either local or foreign, domiciled in Paraguay can be licensed for a maquila export program, and the company that is formed may take any form necessary.

- The ownership of such a company also has very few restrictions, and the Investment Law 117/91 provides equal standing for both national and foreign investments, facilitating easy ownership and divestment, which can only improve confidence in doing business in the country. Paraguayan export industries are also well on the route to adding value to exports, moving away from the focus on raw materials by previous ad- ministrations, and towards completed products.

- The export trade relies on the full support of the government, as the country's infrastructure needs major upgrades – not only from the perspective of Paraguay, but also from Argentina, Brazil and Bolivia – all of which need access to trade routes from their interior-located centres of production, shipping their cargo on Paraguay's river barge fleet. Within the Union of South American Nations (UNASUR) there is a desire to create a bioceanic corridor, linking the Pacific and Atlantic Oceans from Iquique in Chile to Sao Paolo, Brazil, a route that would create a corridor straight through Paraguayan territory.

- The Breadbasket of the World?

-

- Paraguay, located atop the Guarani Aquifer, one of the largest aquifer systems in the world, boasts an enviable topography for the exploitation of its other natural resources. With plains stretching out across the whole country, readily available fresh water, well-connected and easily navigable rivers, and a young population reaching the peak of the ideal demographic (70% of the population is under 34), Paraguay is primed to take the strong growth of recent decades and expand it further.

- Paraguay shines naturally in agriculture, where the country's favourable topography and water table mean it has the potential to become the breadbasket not only for the Americas, but also for the wider Pacific Ocean area, where the resource and produce-hungry Asian economies are on the lookout for partners that can supply their ever-growing middle classes with goods.

- Agricultural in Paraguay has seen huge expansion, with many collectives formed to better export produce to partner countries around the world. And as capacity for producing chia, soy, beef and other goods has increased, so has the need for further development in the transportation systems for this produce, opening up more sectors for inward investors.

- Substantial increases in herd size due to FDI from investors attracted by lower land prices mean national beef production is expected to reach a record 540,000 tonnes, carcass weight equivalent (CWE), this year. Exports are expected to account for nearly two-thirds of that total, with the two key markets, Chile and Russia, purchasing the majority of those at 320,000 tonnes. The export market will substantially increase when Paraguayan meat passes strict European Union health and sanitary tests that will enable exports to reenter the huge trade bloc, after suffering an outbreak of foot and mouth disease in 2011, which closed the market to Paraguayan exporters.

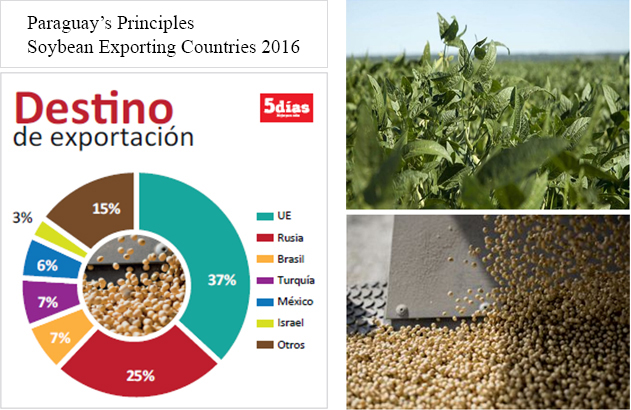

- Highlighting the power of Paraguay's agricultural sector, in 2013 the European Union received 39% of its total grain production, according to the Paraguayan Chamber of Exporters and Traders Grains and Oilseeds (Capeco).

- There are huge investments totalling millions of dollars being ploughed into irrigation infrastructure projects throughout the country, with the government subsidising some 50 to 70% of this. This presents an opportunity for up-to-date, modern irrigation systems, plastic greenhouses, and small agricultural machinery for producers, such as automatic planters that will assist farmers in increasing their already impressive yields.

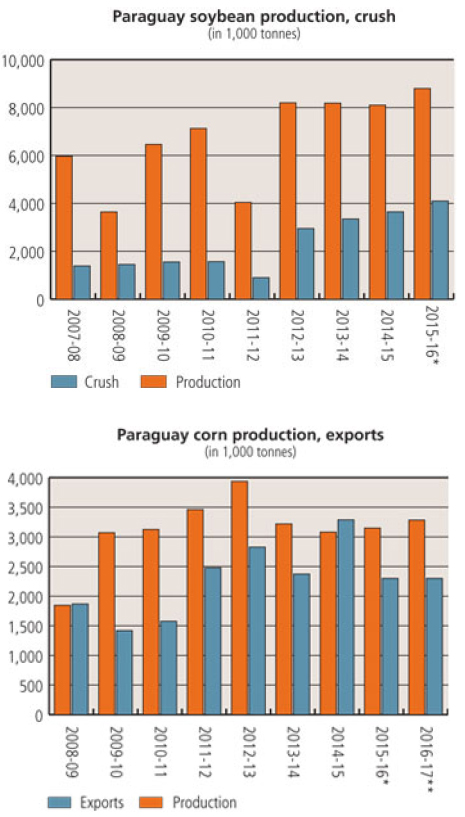

Source: U.S. Department of Agriculture- There is also plentiful, cheap and productive land in the Chaco region for cattle, sugarcane, and soya bean development, although there also needs to be matching investment from the government into the transport network, both on land and via the country's rivers. And to further increase the desirability of the country for investment, there is vast potential for growth – from $800 million to $1 billion – in the agrochemicals and fertilisers sector, presenting an opportunity for companies to develop the proper equipment for each agro-ecological system, and utilise all the business-friendly policies the Cartes government have improved or introduced.

- Following the investment-friendly environment the Cartes government is setting up, the Inter-American Development Bank (IDB) signed a loan of $94.7 million to support the industrialization of Paraguay's soybean sector by giving financing to Angostura SA Agroindustrial Complex (CAIASA) to construct the largest soybean crushing plant in the country. And although the soybean sector accounts for 42% of exports in the agricultural sector, Paraguay traditionally exported unprocessed soya beans to Argentina where they were processed, thereby missing the opportunity to access the revenue chains of products with added value such as soya flour and oil.

- The industrialization of the soybean sector will increase added value by about 40%, and will create jobs directly and indirectly throughout Paraguay. Another bright spot is the reduction in CO2 emissions by some 96,567 tons per year by using boilers fuelled with biomass to produce thermal energy.

- The adaptation of new technologies will help to improve the energy efficiency of the project, the reliability and the quality of the product, while contributing to mitigate environmental and social impact in accordance with international best practice, and help with Cartes' aim to diversify the agricultural products produced in Paraguay, in order to avoid the risks of solely producing raw materials.

- The IDB's participation enabled the project to obtain long term financing at a rate and grace period not achieved by normal commercial sources of funding, and the Fund for International Development OPEC, as a cofunder of the project, will provide a loan of $15 million.

- However, this competitiveness needs to come with added social benefits, as one of the foundations of the Cartes administration is the correct taxation of industry, with agriculture being a prime candidate. To this end, there is the implementation of a new tax and the extension of VAT to include the agricultural sector, which, although key to the economy of Paraguay, only contributed 0.5% to the total amount of tax collected by the treasury in 2012.